Are You Trading Globally or Gambling Your Bottom Line?

Think about your last international shipment. Did it move flawlessly, or was there a moment of anxiety about a missing document, a customs hold, or an unexpected fee? For companies that engage in global trade, the complexity of customs and trade compliance isn't a footnote—it's a central, existential risk.

Regulations change all the time. Global tariffs can shift overnight. And, the volume of customs documentation required for a single transaction can be overwhelming. As we've noted before, in this environment, proactive risk-proofing is essential to shield your supply chain and protect your inbound freight from costly errors.

The stakes are higher than ever. Improper tariff classification, missing permits, or assigning the wrong value to goods can lead to severe consequences: massive fines, supply chain disruptions, and the potential loss of import/export privileges. For example,

Some retroactive customs assessments due to classification errors have been documented to cost companies well over $300,000 plus interest.

The question, then, is simple: Are you absolutely confident your in-house team has the bandwidth and specialized knowledge to manage this constantly moving target?

If the answer is anything less than a resounding "yes," it's time to explore strategic outsourcing. This isn't about simply handing off tasks; it's about transforming compliance from a constant worry into a competitive advantage. This guide will break down the specific compliance pain points and detail precisely how an expert logistics partner offers the specialized knowledge and systems to ensure you ace customs and compliance.

The Anatomy of Customs Risk: Where the Costs Hide

To understand the answer, we must first clearly look at the problems that impact your in-house trade departments. When we talk about trade compliance risk, we're talking about small mistakes that lead to big financial problems.

The HTS Code Maze: A Single Digit Can Cost Millions

The Harmonized Tariff Schedule (HTS) code system is the backbone of global commerce. These multi-digit codes determine the duty rate, special requirements, and admissibility of every product crossing a border. The challenge? They are very complicated and open to interpretation.

A simple misclassification—even by one digit—doesn't just result in an incorrect duty rate today; it opens your company up to a retroactive audit. Customs authorities are strict about accurate classification, and mistakes in this area are one of the most common reasons for major penalties.

For instance, the Canadian Border Services Agency (CBSA) penalties can range from hundreds to hundreds of thousands of dollars per error, and they scale up dramatically with subsequent mistakes. You are not just paying a fine; you are often paying the correct duties plus interest and penalties on up to five years of past shipments. Outsourcing this task transfers this complex liability to specialists who are experts in HTS coding.

The Export Control Tightrope

For companies dealing with technology, defense, or dual-use items, navigating export control regulations (such as the U.S.'s EAR and ITAR) is a zero-tolerance game. These rules govern who you can sell to and what you can sell them.

Dealing with all the required steps—like checking parties against denial lists and recording end-use rules—is complicated. It demands strong security knowledge and awareness of global politics. In-house teams often find it hard to keep up with this constantly changing global information, which can lead to accidental mistakes. These mistakes can result in huge legal and financial fines, as well as harm a company's reputation.

Missed Opportunities in Duty Management

Companies usually see import duties as just a cost of doing business and don't look for ways to save money. This oversight is important when considering whether they should outsource freight management.

This is the tricky part of duty management. You need to make sure you're not gaining any fines, but simultaneously, looking to see how you can cut costs. For example, using Free Trade Agreements (FTAs) like USMCA or CAFTA to their fullest potential. This will save you money. What about the duty drawback program?

Duty drawback lets companies get back almost all of the import duties they paid on goods that are later exported or used in products that are exported. However, about 78% of eligible claims are not filed each year, leaving billions of dollars unclaimed.

Outsourcing as a Compliance Shield: Specialized Solutions

Strategic outsourcing provides an immediate and thorough solution to these challenges by leveraging four critical areas of expertise and technology.

1. Expertise that Scales and Stays Current

Partnering with a third-party logistics (3PL) provider with a savvy customs brokerage team, you gain instant access to experts who constantly stay updated on trade laws. These experts don't treat compliance as a side task; they focus only on tracking and interpreting ever-evolving global trade regulations.

Their knowledge base is constantly updated, helping your company follow all the rules and avoid mistakes that your in-house teams might make. This is called outsourced customs management, and it's a smart way to meet all the latest requirements for international trade.

-

Real-World Example: Imagine a specialized electronics shipment requires a new, obscure country-specific permit introduced just last month. A dedicated 3PL's trade compliance system would immediately flag this requirement, catching a mistake that an in-house team focused on other tasks would probably miss until the shipment is detained at the border.

2. Automated Accuracy and Audit-Proofing

Outsourcing customs and compliance often provides a major benefit: access to advanced technology. A good partner uses systems for automatic classification, validation, and compliance checks.

These automated tools handle manual entry errors and make sure your classifications are consistent across all shipments. Most importantly, they give you a clean and easy electronic audit trail for all transactions. This means that when a customs audit occurs (and they will), all necessary paperwork is instantly available, reducing stress, time, and the likelihood of a penalty.

3. Proactive Duty Strategy and Cost Control

An expert logistics partner shifts the focus from passively paying duties to actively managing them. They develop a duty savings strategy ahead of time:

-

FTA Optimization: They make sure your goods qualify for reduced or eliminated tariffs under the right free trade agreements.

-

Duty Drawback Implementation: They handle the detailed tracking and filing required to claim those valuable duty refunds, turning a refundable cost into a quarterly cash bonus.

This ability to look ahead protects your inbound freight costs from unnecessary increases, as outlined in our blog on inbound freight risk management, and to be proactive when you’re approaching your inbound freight.

Risk-Proofing Your Supply Chain: Beyond the Border

Effective supply chain compliance doesn't end when the paperwork is filed. It involves a bigger strategy that extends throughout your logistics process.

Streamlining Documentation and Record-Keeping

Customs regulations require importers to maintain meticulous records—often for five years or more. For many companies, this is a record-keeping nightmare involving disorganized folders and siloed data.

The outsourced solution manages all entry summaries, commercial invoices, and packing lists. This secure, central storage keeps your records compliant and easily accessible for future checks or audits, helping with risk management.

Vetting Carriers for Compliance

An experienced 3PL recognizes that your partners are an extension of your compliance program. They vet carriers and providers for participation in crucial security programs like C-TPAT (Customs-Trade Partnership Against Terrorism). This vetting process adds a critical layer of security to your supply chain compliance and often results in tangible benefits at the border, such as faster processing times and fewer physical inspections.

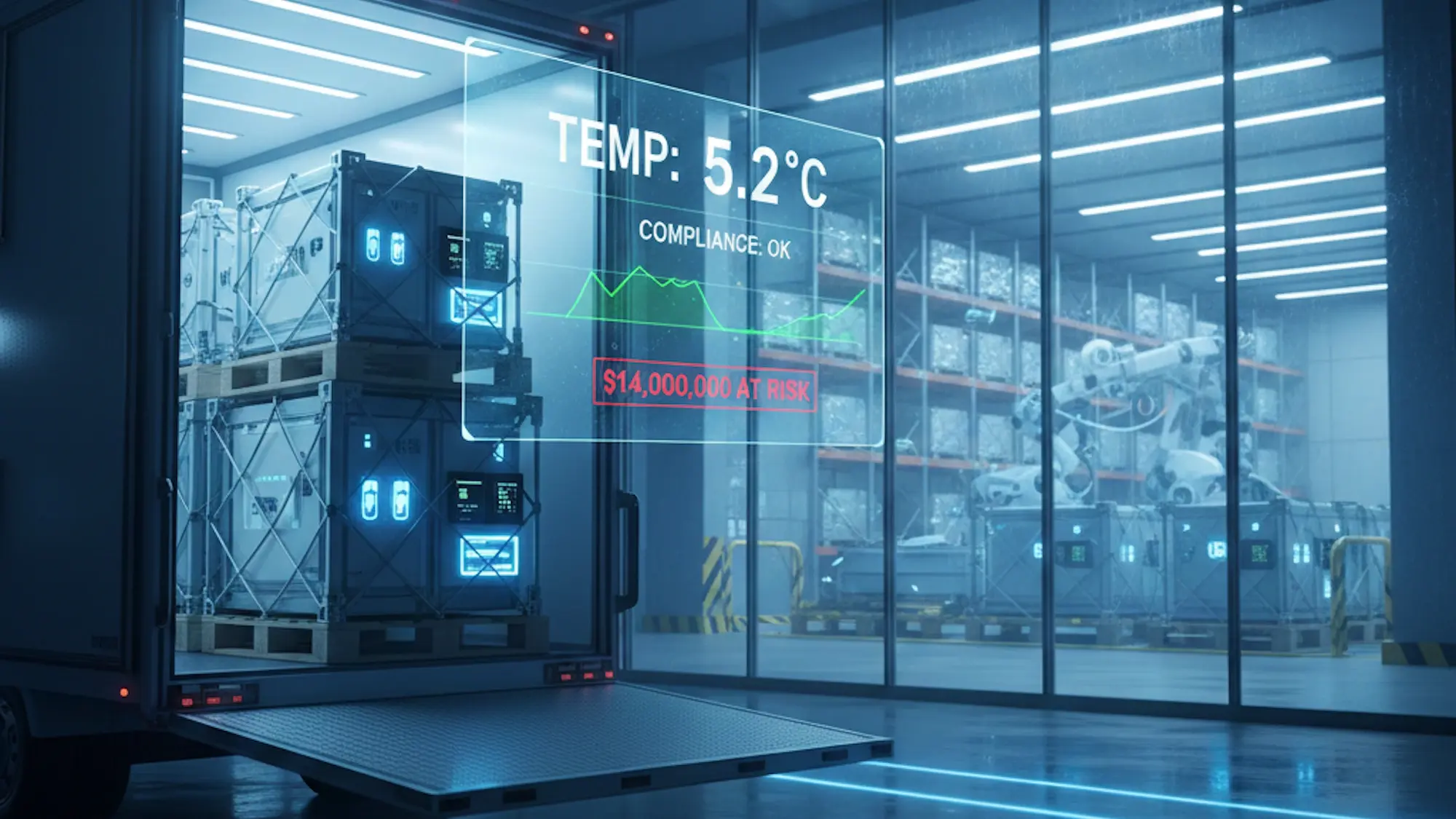

Total Visibility and Actionable Reporting

Finally, a key benefit of strategic outsourcing is the transparent, single-platform view of your entire operation. You receive comprehensive reporting that shows:

-

The real-time compliance status of every shipment.

-

A clear, auditable trail of all declarations.

-

Associated costs, providing the data you need to keep on refining your trade strategy and make sure all stakeholders are on board.

Your Next Step to Guaranteed Customs Efficiency

The reality of complex customs and compliance in today's world is this: the cost of managing it in-house is not what you're paying your team, but the potential costs of mistakes and, more importantly, the value of missed duty-saving opportunities.

By partnering with an experienced logistics leader, you're not worrying about the fine print. You get immediate access to a proactive, expert-driven system built to minimize costs, eliminate fines, and ensure your shipments move across borders without a problem.

Ready to move past worrying about compliance and toward guaranteed customs efficiency? Customodal provides the expert-level customs management and advanced technology required to secure your entire global operation. We turn complex customs and trade compliance into a seamless, competitive advantage, freeing your team to focus on growing your core business.

Contact Customodal today for a detailed compliance review and start taking control of your supply chain.