What if the parts your heavy equipment spits out were just as valuable as the ones you put in? For many operations and finance leaders, reverse logistics—the flow of goods back from the point of consumption—is a dreaded cost center. It shouldn't be.

In the world of critical infrastructure, heavy machinery, and high-value assets, this back-end process is fundamentally different. We aren't talking about simple e-commerce returns. We're discussing Maintenance, Repair, and Operations (MRO) components—high-value, highly critical parts, such as engine cores, transmission assemblies, specialized hydraulic pumps, and warranty items. Their efficient return is not optional; it's essential to maximizing asset longevity and minimizing capital expenditure.

This process is so complex that a transactional approach guarantees you're losing money. The actual strategic value lies in complex reverse logistics optimization. The goal is simple: move beyond merely minimizing loss to actively maximizing asset recovery and turning what you considered waste into documented financial value.

Let’s explore the financial realities of neglecting this crucial area and detail the strategic steps required to transform your returns process from a cost burden into a profit-driving engine.

Why Is Reverse Logistics for MRO a Financial Burden? (And How to Fix It)

Ask yourself this: When a critical component fails in the field, is the process for getting the old part back treated with the same urgency as sending out the replacement? For most companies, the answer is a resounding 'no,' and that gap represents a massive, unnecessary financial drain.

1. The Core Deposit Disaster

The single most significant, yet often overlooked, financial risk in MRO returns is the core management penalty. When you purchase a remanufactured part—such as a rebuilt engine or large alternator—you often pay a hefty core deposit. This deposit is a mechanism used by Original Equipment Manufacturers (OEMs) to ensure they get the old, failed unit (the "core") back for refurbishment.

What happens if you miss the return deadline, or if the core is returned damaged due to poor handling? You lose the deposit.

In heavy machinery sectors, unrecovered core deposits can easily represent anywhere from 10% to 20% of the replacement component's overall cost.

This isn't small change; it's thousands of dollars vanishing simply because a logistics process lacked urgency and control.

2. Inflating the Total Cost of Ownership (TCO)

The consequences of poor reverse logistics flow directly to your balance sheet via the Total Cost of Ownership (TCO) of your equipment. Slow, disorganized component returns delay the OEM’s or your internal refurbishment pipeline.

If a core takes six weeks to return, process, and repair, that's six weeks added to the lead time for the next customer who needs that specific remanufactured part. This scarcity can drive up replacement costs or, worse, increase the likelihood of heavy equipment downtime because the necessary spare parts are not in circulation. As we've discussed before, neglecting the specialized nature of logistics for critical components is a primary source of hidden costs—the "hidden cost of cheap logistics" is very real, especially in the reverse flow.

3. The Visibility Void and Supply Chain Blind Spots

One of the most persistent problems in logistics is the visibility gap. If your team can't instantly track a replacement part on its way to the field, how can you expect them to track the used part on its way back?

A lack of real-time visibility and clear accountability for the returning asset creates risk and uncertainty. Is it sitting in a field service truck? Is the required regulatory paperwork with it? Is the clock ticking on a core deadline? When you are dealing with critical parts, you simply cannot afford not to fix your supply chain blind spots and prevent equipment downtime.

Defining Complexity: What Makes MRO Returns Unique?

The term complex reverse logistics exists for a reason, and it’s especially true for MRO. MRO components are fundamentally different from consumer returns, demanding a specialized level of attention.

High-Value, High-Stakes

MRO returns are rarely destined for the trash heap. They are assets intended for repair, refurbishment, or recycling, making their safe transit paramount. This is a critical factor for maintaining machinery uptime.

-

Regulatory Hurdles: A used industrial battery, a hydraulic fluid reservoir, or even a defective component with residue may fall under strict regulatory guidelines (e.g., DOT or IATA). Improper classification, labeling, or documentation will lead to delays, fines, or seizure.

-

Chain of Custody for Warranty: For warranty items, the documentation is key. The precise, verifiable path of the component from the field back to the manufacturer is required for a successful claim. The paperwork—the proof of condition and transit—is often as valuable as the part itself.

- The Multi-Point Journey: Reverse logistics is rarely simple A-to-B shipping. The part might flow from a remote site > to a regional consolidation depot > to an in-house repair facility > to the final OEM or remanufacturer. A successful strategy must manage every touchpoint in this intricate network to ensure the item stays on track to regain value.

This complexity underscores the need to ask your logistics provider the right questions, ensuring they are genuinely an SFM provider capable of managing your uptime, not just your movement. When choosing your uptime partner, it's essential to gauge their expertise in handling these complex, multi-stop moves.

The Four Pillars of Revenue-Driving Reverse Logistics

The path to achieving reverse logistics optimization is not found in cheaper shipping rates, but in implementing strategic, systemic controls. These four pillars transform returns from a costly headache into a predictable source of financial recovery and asset availability.

1. Pillar 1: Proactive Core Management Protocol

This is the most direct route to turning a cost into revenue. The strategy requires a systematic process for tracking core deposits and their return deadlines at the time of the replacement shipment. The process must be embedded into the initial transaction.

A truly specialized provider implements an automated system that:

-

Registers the core return window immediately.

-

Automatically generates the required prepaid return labels, customs paperwork, and precise documentation.

-

Includes a notification system that alerts field personnel and operations managers well before the core deadline expires.

By treating the return with the same automated urgency as the outbound shipment, you guarantee the successful, on-time redemption of your core deposit. This proactive core management eliminates a major financial risk.

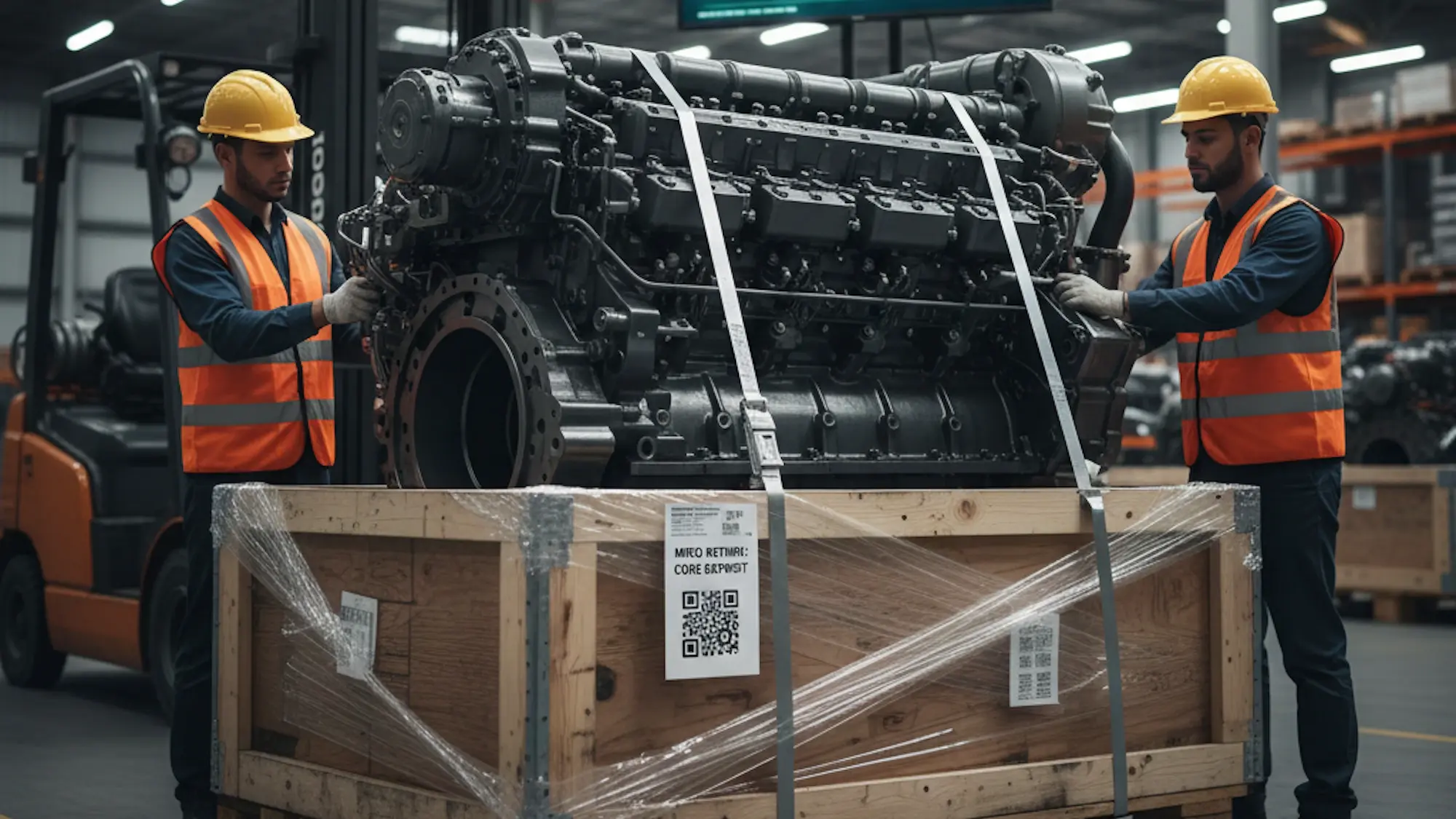

2. Pillar 2: The "White Glove" Treatment of High-Value Returns

You must treat the reverse shipment with the same specialized care and precision you demand for a critical part heading to the field.

Returning components, particularly specialized machinery parts, require dedicated, pre-vetted carriers who understand industrial freight and often demand specialized crating or protective packaging. Why? Because if a failed pump is shipped back unprotected and suffers further damage in transit, the OEM may reject it, voiding the valuable core credit or the potential for repair.

Protecting the component on its return journey is a direct act of asset recovery. This kind of critical handling is what differentiates successful AOG logistics from standard freight—the sensitivity is paramount for preserving value.

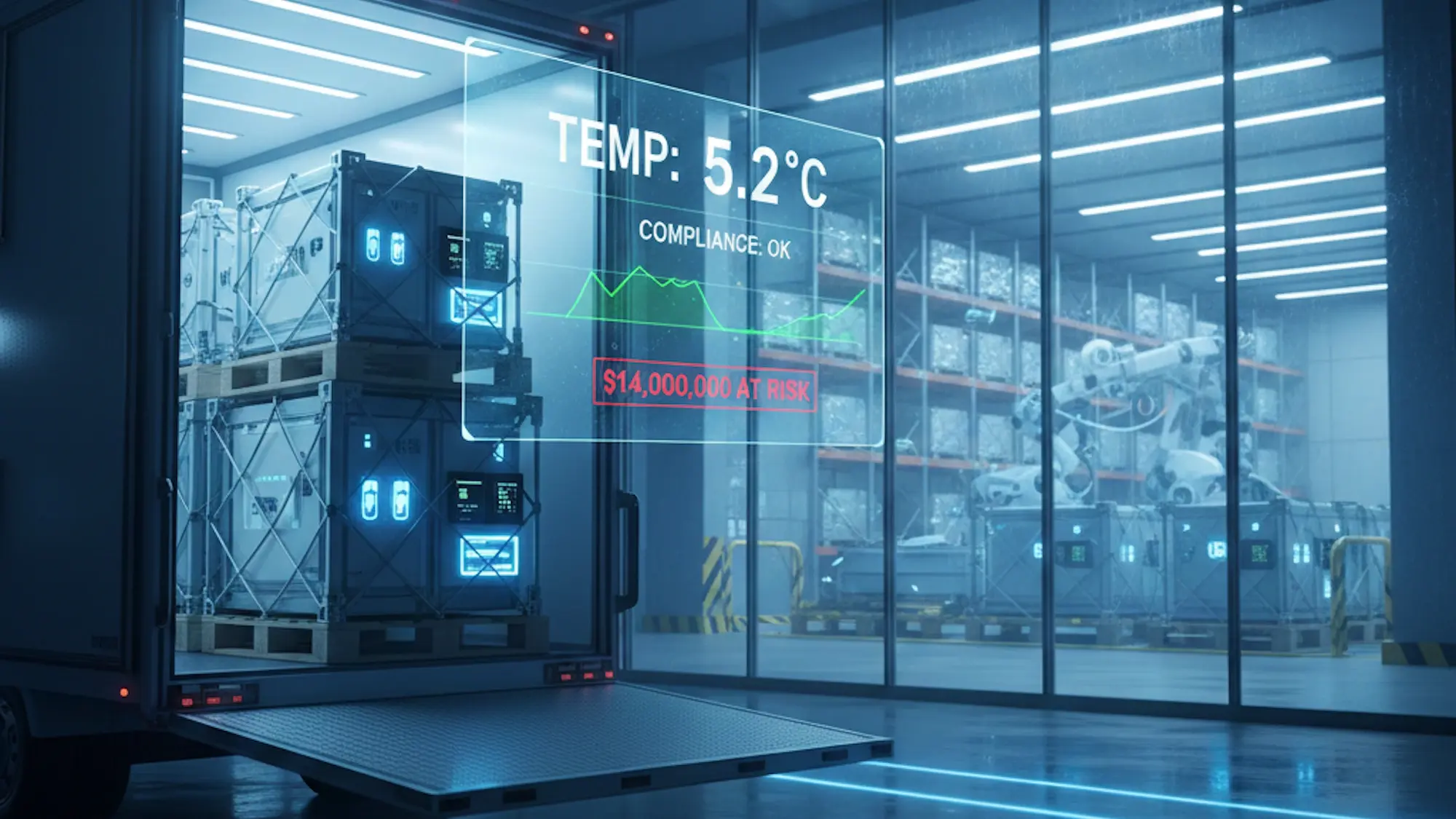

3. Pillar 3: Centralized Visibility and Data Integrity

You cannot optimize what you cannot see. Strategic reverse logistics optimization demands a single source of truth—a unified platform that tracks both forward and reverse flows.

This platform must answer the critical questions:

-

Where is the part right now?

-

Is the paperwork complete?

-

When is it due?

This level of centralized visibility accelerates the refurbishment and recycling cycle, which has a significant economic impact.

Industry data suggests that improved reverse logistics visibility can reduce overall inventory holding costs by 10% to 20% by accelerating the entire loop and getting components back into circulation faster.

When you combine this with the specialized carrier network required for your sensitive MRO component returns, you drastically reduce uncertainty and risk.

4. Pillar 4: Strategic Logistics Partnership

Complexity demands specialization. A general freight carrier that treats a high-value, regulated core return the same as a box of office supplies is ill-equipped for this challenge.

Reverse logistics for MRO components requires a partner who deeply understands the high stakes, the regulatory requirements, and the time sensitivity of industrial parts. This partner should view the reverse flow not as an inconvenience but as a specialized opportunity to create financial value and improve your operational efficiency.

Beyond Cost-Saving to Value Creation

An optimized reverse flow for MRO components is much more than a box-checking exercise. It is a critical function of financial health and asset preservation.

By moving away from a transactional mindset and implementing a proactive, strategic protocol, you achieve three things:

-

Guaranteed Capital Recovery: You maximize core deposit redemption, protecting your capital.

-

Accelerated Uptime: You reduce bottlenecks in the refurbishment pipeline, securing the availability of spares.

-

Lower TCO: You gain complete control over one of the most volatile segments of your supply chain.

This level of strategic execution requires more than a carrier; it requires a specialized freight manager. We understand that effective complex reverse logistics demands precision planning, meticulous documentation, and a dedicated network capable of handling high-value components with sensitivity and speed. Customodal offers unified visibility and specialized expertise, enabling you to transform your returns process into a revenue-generating, value-driven asset.